The Last Five Years: Naples Housing

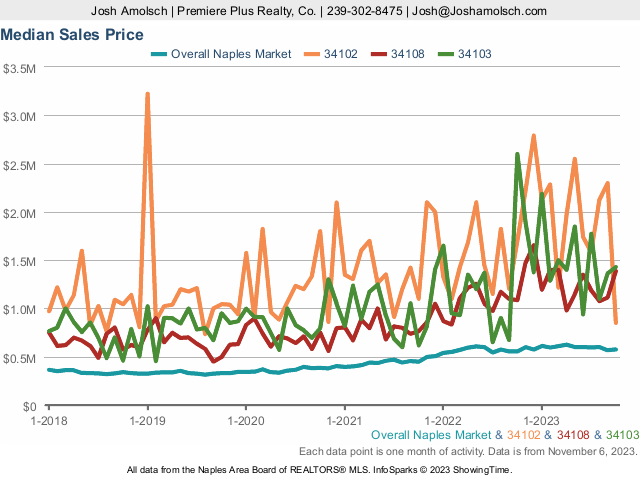

Naples October 2023 Housing Prices

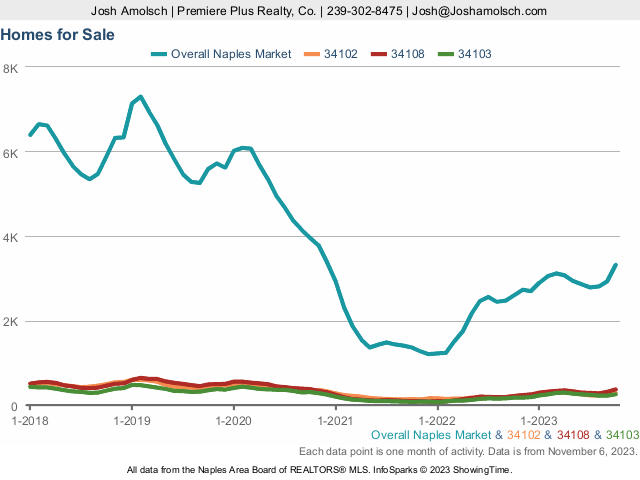

Naples October 2023 Homes for Sale

- Below 6%: 91.8% of U.S. mortgaged homeowners have a rate below 6%, down from a record high of 92.9% in the second quarter of 2022.

- Below 5%: 82.4% have a rate below 5%. That’s down from a peak of 85.7% in the first quarter of 2022.

- Below 4%: 62% have a rate below 4%, also down from a record high (65.3%) hit in the first quarter of 2022.

- Below 3%: 23.5% an interest rate below 3%, near the highest share on record. The highest was 24.6% in the first quarter of 2022.

“Many would-be sellers are staying put rather than listing their home to avoid taking on a much higher mortgage rate when they purchase their next house. This “lock in” effect has pushed inventory down to record lows this spring. New listings of homes for sale and the total number of listings have both dropped to their lowest level on record for this time of year, which is fueling homebuyer competition in some markets and preventing home prices from falling further even amid tepid demand.”

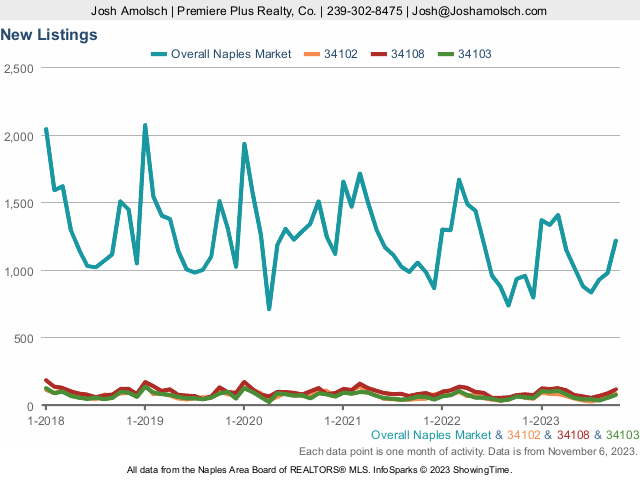

Naples October 2023 Home Listings

Unequal But Connected Housing Demand

- Wages need to increase 60%

- Interest Rates need to drop by 4%

- Home prices need to drop by 37%

Do you see your income increasing by 60% anytime soon? I really hope it does! Do you see interest rates dropping by 4% anytime soon? You can bet your favorite pair of shoes that if rates drop by half or if wages on a big scale increase by 60% that home prices with increase to ever higher levels, making affordability even worse. Think about it. Now let’s talk about if home prices drop by 37%. To put this in context, home prices dropped by about 30% from the peak in mid-2006 to the trough in mid-2009 during the Great Recession according to several sources on the web, including Investopedia. If we started to see a drop in home prices like that, again betting those shoes, we would surely see a slew of listings hitting the market as homeowners rush to pull out their equity before it evaporates. This could be the way that all of those people holding on to super low mortgage rates start to sell. Timing the market is near impossible, but maybe considering that sale to protect the equity blessing isn’t such a bad idea before prices start coming down. That is, if you believe that they will. Nothing lasts forever, not even historically low interest rates.

Naples Housing May Need to Wait

Josh Amolsch | Naples Luxury Real Estate